Foreign Exchange Market with Official Certification

Accredited by The Quality License Scheme | Endorsed Certificate Included | Unlimited Access for 365 Days | Tutor Support

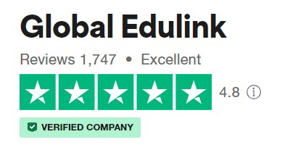

Global Edulink

Summary

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

- TOTUM card available but not included in price What's this?

Add to basket or enquire

Overview

Diploma in Foreign Exchange Market at QLS Level 3

This course is endorsed under the Quality Licence Scheme.

The Diploma in Foreign Exchange Market at QLS Level 3 course is designed for finance and accounting professionals. The course is packed with an overview of the foreign exchange market and is for professionals who are interested in the foreign currency market, and want to scale the learning curve. The goal of the course is to enable learners to understand the fundamentals of the FX market and navigate through a global market around the clock in an efficient manner.

The course will enable learners to set international business objectives, learn how businesses and the government participate in the foreign exchange market, and learn about technical and fundamental analysis to forecast exchange rates and how time zones can impact trading worldwide.

The Diploma in Foreign Exchange Market at QLS Level 3 is a unique course that enables learners to understand currency risk management, and how the currency market plays a significant role in the macro-economy. The course is also highly effective for professionals in many fields to learn the intricacies of how the FX market works and make it an investment and a career standing.

The Quality Licence Scheme, endorses high-quality, non-regulated provision and training programmes. This means that Global Edulink has undergone an external quality check to ensure that the organisation and the courses it offers, meet defined quality criteria. The completion of this course alone does not lead to a regulated qualification but may be used as evidence of knowledge and skills gained. The Learner Unit Summary may be used as evidence towards Recognition of Prior Learning if you wish to progress your studies in this subject. To this end the learning outcomes of the course have been benchmarked at Level 3 against level descriptors published by Quality Licence Scheme, to indicate the depth of study and level of demand/complexity involved in successful completion by the learner.

This course has been endorsed by the Quality Licence Scheme for its high-quality, non-regulated provision and training programmes. This course is not regulated by Ofqual and is not an accredited qualification. We will be able to advise you on any further recognition, for example progression routes into further and/or higher education. For further information please visit the Learner FAQs on the Quality Licence Scheme website.

Why Choose Global Edulink?

Global Edulink offers the most convenient path to gain skills and training that will give you the opportunity to put into practice your knowledge and expertise in an IT or corporate environment. You can study at your own pace at Global Edulink and you will be provided with all the necessary material, tutorials, qualified course instructor, narrated e-learning modules and free resources which include Free CV writing pack, free career support and course demo to make your learning experience more enriching and rewarding.

Achievement

Course media

Description

COURSE CURRICULUM

Module 01 : Foreign Exchange Market an Introduction

- Essence

- Learning objectives

- The foreign exchange market in a nutshell

- Organizational structure of the forex market

- Monetary unit

- Foreign exchange and bank deposits

- International spot rate quotation conventions

- Two- Way spot prices

- Spread

- Cross Rates

- Spot and derivative forex markets

- Why exchange rates are important

Module 02 : Derivatives Forwards

- Learning objectives

- Derivatives markets

- Definition of a foword

- Types of forwards

- Outright forwards

- Forex swaps

- Time Options

- Forward-forwards

- Outright forward foreign exchange contracts : functions and pricing

- Hedging and investment

- Speculation

- Covered interest arbitrage

- Principle of interest rate parity and the pricing of forward contracts

- Forward exchange market

Module 03 : Derivatives Futures, Options & Swaps

- Learning objectives

- Currency features

Module 04 : Risks Other Than Currency Risk & Other Risk Management Tools

- Risks other than currency risk in investments

- Interest rate risk

- Market risk

- Credit risk

- Transaction tools

- Settlement risk

- Market size

- Availability and reliability of information

- Valuation of markets

- Trading methods

- Other risk management

- Currency risk insurance

- Utilization of local loans

- Dual- currency bonus

- Pre payment for exports

- Barter

- Selective currency pricing

- Risk-adjusted pricing

- Leads and lags

Module 05 : Participants

- Authorized dealer banks

- Foreign exchange banks

- Foreign banks

- Central bank

- Buyer and seller of foreign exchange

- The desired level of reserves

- Brief overview of reserve management

- Administrative of exchange controls

- Government

- Retail clients

- Non-Bank authorized dealers

- Corporate sector

- Arbitrageurs

- Speculators

Module 06 : Effect on Money Stock & Money Market Liquidity

- Money identify

- Money market identify

- Significance if the liquid shortage

- A concept of bank liquidity:net excess reserves

- Purchase and sales of forex,M3 and the liquidity shortage

Access Duration

The course will be directly delivered to you, and you have 12 months access to the online learning platform from the date you joined the course. The course is self-paced and you can complete it in stages, revisiting the lectures at any time.

Method of Assessment

In order to complete the Level 3 Diploma in Foreign Exchange Market successfully, all students are required to complete a series of assignments. The completed assignments must be submitted via the online portal. Your instructor will review and evaluate your work and provide your feedback based on how well you have completed your assignments.

Certification

Those who successfully complete the course will be issued the Diploma in Foreign Exchange Market at QLS Level 3 by the Quality Licence Scheme.

Course Code: QLS-04458

Endorsed by

The Quality Licence Scheme is part of the Skills and Education Group, a charitable organisation that unites education and skills-orientated organisations that share similar values and objectives. With more than 100 years of collective experience, the Skills and Education Group’s strategic partnerships create opportunities to inform, influence and represent the wider education and skills sector.

The Skills and Education Group also includes two nationally recognised awarding organisations; Skills and Education Group Awards and Skills and Education Group Access. Through our awarding organisations we have developed a reputation for providing high-quality qualifications and assessments for the education and skills sector. We are committed to helping employers, organisations and learners cultivate the relevant skills for learning, skills for employment, and skills for life.

Our knowledge and experience of working within the awarding sector enables us to work with training providers, through the Quality Licence Scheme, to help them develop high-quality courses and/or training programmes for the non-regulated market.

Other Benefits

- Written and designed by the industry’s finest expert instructors with over 15 years of experience

- Repeat and rewind all your lectures and enjoy a personalised learning experience

- Unlimited 12 months access from anywhere, anytime

- Excellent Tutor Support Service (Monday to Friday)

- Save time and money on travel

- Learn at your convenience and leisure

- Eligible for TOTUM discount card

Who is this course for?

- Accounting Professionals, Financial Professionals

- Foreign Exchange salespersons

- Business Consultants

- Financial Analysts

- Anyone who is looking to gain a knowledge and skills in Foreign Exchange Market.

Requirements

- Learners should be age 19 or over, and must have a basic understanding of Maths, English, and ICT.

- A recognised qualification at level 2 or above in any discipline.

Career path

- Accounting Manager - £31,357 per annum

- Business Consultant – £38,159 per annum

- Financial Analyst – £30,998 per annum

- Financial Controller – £47,040 per annum

Questions and answers

Concerning assessment, if I submit a piece of work & it fails the criteria to pass assessment for any module, if there facility to resubmit the work?

Answer:Dear Jane Thank you very much for your query. Since you are receiving the mentor support there is a less chance to get fail however the requested facility is also available. Regards, Student Support Team.

This was helpful.Please provide more information about the assessments

Answer:Dear Simon Thank you for your query. In order to complete this course successfully,students are required to complete a series of assignments. & must be submitted via the online portal. Your instructor will review and evaluate your work and provide feedback. While the assignment is compulsory for you to get your ABC Awards accredited certification, you can also receive another CPD & iAP accredited, free e-certificate if you take a 20 multiple choice exam. Regards, Student Support Team.

This was helpful.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.